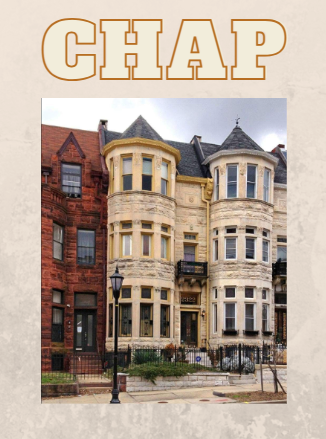

Nestled within the vibrant tapestry of Maryland’s rich historical landscape, the CHAP (Commission for Historical and Architectural Preservation) Historic Tax Credit stands as a beacon of hope for property owners and developers alike. This tax incentive is not just a financial tool; it’s a lifeline that breathes life into historic buildings, ensuring they continue to tell their stories for generations to come. At O’Connell & Associates, a leader in Maryland Historic Tax Credit Services, we are passionate about unlocking the potential of these credits for our clients. Join us as we delve into the essence, benefits, and impact of the CHAP Historic Tax Credit.

The Heart of CHAP

The CHAP Historic Tax Credit is designed to incentivize the preservation and rehabilitation of historic buildings within designated districts. Its aim is multifaceted: to preserve Baltimore’s rich architectural heritage, encourage sustainable urban living, and stimulate economic growth through redevelopment. Unlike federal incentives, the CHAP credit is a local initiative, showcasing Baltimore’s commitment to its historic fabric.

Qualifying for the Credit

Qualification hinges on several key criteria. Firstly, the property must be located within a CHAP District or be individually designated as a landmark. Rehabilitation efforts must meet specific standards, ensuring they preserve the historic character of the property while making it suitable for modern use. These projects can range from residential to commercial, each bringing its unique challenges and rewards.

The Financial Incentive

At its core, the CHAP Historic Tax Credit offers a substantial property tax credit, calculated as a percentage of the cost of approved rehabilitation work. This can significantly reduce the financial burden on property owners, making daunting preservation projects not just feasible but attractive. It’s a win-win scenario: the community benefits from the preservation of its historical landscape, and property owners gain from a reduced tax liability and increased property value.

Beyond Economics: The Ripple Effect

The benefits of the CHAP Historic Tax Credits extend far beyond mere financial savings. They serve as a catalyst for community revitalization, turning neglected buildings into vibrant homes, businesses, and cultural spaces. This revitalization fosters a sense of pride and place, strengthening community bonds. Moreover, it contributes to the environmental sustainability of urban development by promoting the adaptive reuse of existing structures.

Navigating the Process with O’Connell & Associates

Securing a CHAP Historic Tax Credit can be a complex process, fraught with regulatory challenges and detailed documentation requirements. This is where O’Connell & Associates steps in. With our deep understanding of Maryland’s historic tax credit landscape and a track record of success, we guide our clients through every step of the process. From initial assessment to final approval, we ensure that your project not only qualifies for the CHAP credit but also maximizes its benefits.

Conclusion

The CHAP Historic Tax Credit is more than just a financial incentive; it’s a cornerstone of Baltimore’s preservation strategy. Targeted historic preservation investments pay dividends for property owners, communities, and the city. At O’Connell & Associates, we are proud to be at the forefront of this transformative journey, helping our clients navigate the complexities of the CHAP Historic Tax Credit. Together, we are not just preserving buildings; we are preserving the soul of our city, one project at a time.